In recent years, the cryptocurrency landscape has witnessed a seismic shift, fueled by the proliferation of new mining technologies and the burgeoning demand for digital assets like Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOG). The United States, traditionally overshadowed by overseas manufacturing giants, is now emerging as a formidable player in the mining hardware industry. Innovative domestic brands are not only designing cutting-edge mining rigs but are also capturing investor attention through their advanced, energy-efficient solutions tailored for hosting mining operations and large-scale mining farms.

The word “mining” in crypto circles conjures images of relentless computational work, where miners leverage the power of ASICs (Application-Specific Integrated Circuits) or high-performance GPUs to solve cryptographic puzzles. What distinguishes the new wave of U.S. mining hardware brands is their focus on optimizing these machines for maximum hash rates while remaining mindful of energy consumption—a crucial consideration as sustainability becomes a core industry concern. These mining rigs are engineered to support multiple cryptocurrencies, including BTC, ETH, and even altcoins like DOG, bridging versatility with raw power.

The resonance of these mining machines extends beyond individual miners to enterprise-level mining farms. Such farms aggregate hundreds, sometimes thousands, of mining rigs to amplify operational scale and profitability. U.S. brands have innovated modular and scalable mining units, facilitating rapid deployment in hosting facilities—where miners rent out space and infrastructure. Hosting mining machines mitigate the complexities of operations for individual miners, providing a vehicle to engage with cryptocurrencies like BTC and ETH without owning physical setups or wrestling with energy management.

Moreover, the integration of mining hardware with blockchain exchanges has grown more sophisticated. Cryptocurrency exchanges increasingly collaborate with miners to foster ecosystem synergy, where tokens mined through proprietary hardware get seamlessly listed or traded. This symbiosis not only stimulates direct investment into mining ventures but underpins the liquidity of tokens like DOG and ETH on global exchanges. For U.S.-based hardware suppliers, this connectivity presents a strategic advantage, opening new revenue channels via exclusive partnerships with mining farm operators and crypto trading platforms.

Investor enthusiasm surrounding these emerging brands is not arbitrary; it is backed by palpable technological advancements and a growing appetite for domestically sourced mining equipment. ASIC manufacturers, historically concentrated in Asia, now face competition from U.S. firms embracing custom chip design to enhance efficiency tailored for Bitcoin’s SHA-256 algorithm or Ethereum’s Ethash. This diversification has invigorated the market, attracting capital into research and development, which promises next-generation miners capable of delivering exponentially higher throughput.

Dogecoin, once viewed as a meme-based novelty, further illustrates the dynamic nature of mining hardware requirements. Its Scrypt-based mining mechanism necessitates different computational capabilities compared to BTC’s mining algorithm. Some new mining rigs introduced by U.S. companies exhibit adaptability to multiple hashing functions, enabling miners to pivot between cryptocurrencies depending on market conditions. This flexibility imbues miners with tactical options for maximizing profitability amidst the volatile crypto markets, an enticing prospect for investors looking for multifaceted exposure.

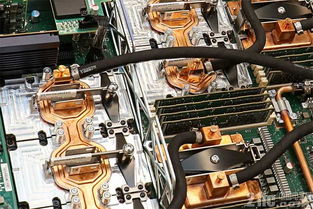

The narrative extends beyond hardware and machines to the strategic positioning within the mining ecosystem. Hosting services are evolving from mere colocation providers into integrated technology partners. They incorporate remote monitoring, heat management solutions, and tailored software to optimize mining performance for operators entrenched in more than just BTC mining. Ethereum’s shift towards a proof-of-stake consensus with ETH 2.0 may impact mining hardware demand, but until the full transition happens, ETH mining rigs remain pivotal in determining network security and token issuance.

In parallel, miners themselves—the actual operators and owners of mining rigs—are recalibrating their strategies. As the complexity and costs associated with mining accrue, many are outsourcing hardware management to hosting facilities or investing in diversified mining farms. The U.S. brands’ hardware offerings cater precisely to this trend through products designed for durability, low noise pollution, and optimal cooling architectures, thereby boosting uptime and reducing operational headaches.

Finally, the infusion of institutional capital into mining hardware firms manifests the maturation of the crypto mining sector. Venture capitalists and private equity retain keen interest in companies showcasing scalability, innovation, and integration capacity with crypto exchanges and hosting services. These emerging U.S. brands epitomize these qualities, embedding themselves not just as suppliers of machinery but as pivotal nodes in the cryptocurrency economy’s value chain.

Leave a Reply